Contents:

They will be legally obligated to protect your financial interest. It entails selling a deal almost as soon as it becomes lucrative. The blog posts/articles on our website are purely the author’s personal opinion. The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice.

From Startup to Trading: An Entrepreneur’s Guide to Trading … – CEOWORLD magazine

From Startup to Trading: An Entrepreneur’s Guide to Trading ….

Posted: Tue, 28 Mar 2023 07:00:00 GMT [source]

However, as a day trader, you can trade in the market for 24 hours such as forex market, currency market and futures markets. Aradhana Gotur is a Content Writer with 4 years of experience in personal finance, stock markets, and lifestyle areas. Having recognised the power of words, she constantly works on using them to enhance financial awareness among the masses and meet business objectives. One of her greatest strengths is breaking complex concepts in an easy-to-understand way. Fading is considered a risky strategy that involves shorting stocks after it has moved upwards drastically. Momentum revolves around trading on news sources or identifying strong trending moves with high volume.

Nifty call put option data

That said, price action has a greater significance in the case of a scalping strategy. When picking stocks, individuals opting for this intraday trading strategy must ensure that they choose shares that are liquid as well as volatile. Furthermore, they must make sure to put in a stop loss for all orders. As the name suggests, the basis of this strategy for intraday trading is to make the most of the momentum in the market. This involves tracking the right stocks before a significant change in the market trend materialises.

We have a sell signal when the 5MA crosses the 20MA from above . Exit is also possible if the 5 MA crosses the 20 MA from below . You may wish to keep an options straddle by buying calls and puts of 3600 strike. But sometimes, the option premium will not be same for call and put. So we buy 2 lots in call and 1 lot in put, to make the proportion equal. But what I have observed with this last 13 years of data is, Market has always moved in one side direction with huge trend once the budget session is over.

The trades can be placed with the brokerage firm by either calling the broker or logging into your trading account. The trading account should allow the trader to trade in the desired asset, such as currency or commodities. Position-sizing refers to the number of shares or contracts a market participant, such as a trader, risks with each trade.

BSE reduces lot size, changes expiry day to boost F&O trading in Sensex, Bankex

Investments in securities market are subject to market risk, read all the related documents carefully before investing. Angel One’s Angel Eye has charts and portfolio watch tools that helps in identifying trends, and thus helping traders to make better decisions. Angel One’s Angel Eye has charts and portfolio watch tools that help in identifying trends,and thus helping traders to make better decisions.

- In this strategy, the entire focus should be on stocks that have momentum and are frequently moving in one direction and high volumes.

- Day trading is a form of dealing in shares in a single day where people can make money because of small fluctuations in the price.

- Nevertheless, you should be cautious when trading equities that are too sensitive to events.

- However, when you combine the RSI and ADX, intraday traders buy when the RSI crosses the upper limit and vice versa.

- When the market opens, this strategy helps traders get the maximum benefit of the fierce action from the selling and buying orders in a massive quantity.

Please conduct your own research and due diligence before investing. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Please read the Risk Disclosure documents carefully before investing in Equity Shares, Derivatives, Mutual fund, and/or other instruments traded on the Stock Exchanges. As investments are subject to market risks and price fluctuation risk, there is no assurance or guarantee that the investment objectives shall be achieved.

Day Trading Strategies for Beginners

Ever since rolling settlements were introduced in what is mortgage-to-worth ratio, intraday trading has taken off in a big way because that is the only one can trade on the short side in equities. Professional traders, proprietary traders and individuals are all participants in day trading. While day trading can be profitable and also appear exciting, it is risky, time-consuming, and stressful.

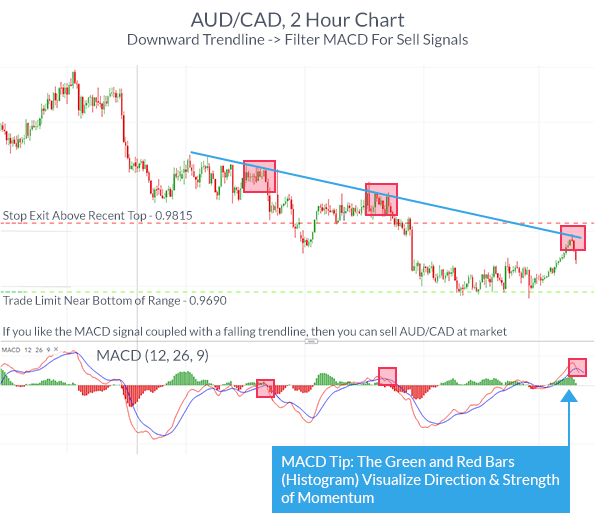

Normally, a breakout occurs when a stock has surged above a significant area of price resistance. The breakout could occur above a consolidation point or above a downtrend line. In that case, the instrument falls below a significant area of support, which can be either a consolidation point or below an uptrend line.

Make sure that your broker has a responsive and cooperative customer care service. Invest in stocks with Free Expert Advice only with MO INVESTOR. Whenever such events occur in the marketplace, there is increased uncertainty, which in turn increases the volatility in the market. Ltd. makes no warranties or representations, express or implied, on products offered through the platform. It accepts no liability for any damages or losses, however caused, in connection with the use of, or on the reliance of its product or related services.

Top Intraday Trading Tips and Strategies

The open high-low strategy is one of the best intraday trading strategies for beginners to learn. Although the accuracy rate varies between 50 and 70%, this strategy can help you succeed in intraday trading if used with proper risk and money management. The drawback of news trading strategy is that there can be few and far fewer positive happenings. More often than not, the buzz has already been included into the stock price by the time you see it.

However, for the https://1investing.in/-exchange to execute these orders, there must be enough liquidity in the market. Is one of the leading Indian financial corporations aimed to make trading easier for everyone, even for those who are from a non-trading background. Being in the market for over 11 years, Tradebulls has earned its huge clientele of 2 Lakh+ clients, 2750+ business partners till date. Tradebulls is here for you with its professionally trained team to offer knowledge and guide you through the same. In a breakout market strategy, a trader enters the market when the price goes beyond its own resistance and support. Technical indicator volume is used by the traders to search such a pattern in the market.

Essential components for day trading strategies

Though this might not sound like an intraday tip, learning the basics of technical analysis is a must if you want to understand the game of trading intraday. For example, momentum trading helps traders identify how strong the trend is in a given direction and its capacity to sustain itself. This is when the buyer immediately starts having second thoughts and starts doubting their play.

The price of this company has been rising gradually in an uptrend. However, it has shot up 27% from the low of Rs 2,300 made in February and now appears unstable. The price has formed a back-to-back Doji candlesticks at the top and thereafter it has started correcting. In the short term, the price is expected to test its recent swing low. If the asset is overbought, the trend is going to reverse and the trader should take a short position. Intraday trading can yield positive payoffs if the trader is vigilant and responsive to market events without biases.

A trade trigger identifies the exact point at which a trade will be entered. All trading strategies will have rules for entry, exit, risk management, and position-sizing. The trader will lose all the equity value as well as the loan amount, in addition to the cost of bearing interest on margin capital. However, if the trader’s position falls below the minimum maintenance margin, a margin call is initiated.

Diversification will help you balance your intraday trade strategy and minimize your risk. Update your mobile numbers/email IDs with your stock brokers/Depository Participant. Receive alerts/information of your transaction/all debit and other important transactions in your Trading/ Demat Account directly from Exchange/CDSL at the end of the day.